Netflix is the poster child of a company that has benefited from Covid-19 related lock downs as people are forced to stay at home. It is not surprising that their stock price is up roughly 50% this year alone. However, it is still not too late. In fact, we think that the Covid-19 crisis has substantially reduced the risks facing Netflix and improved the risk-reward equation of owning the stock now.

Our firm had a small sized investment in Netflix since late 2019. We had kept it small because, at that time, there were considerable risks facing the business.

First, several competing streaming services were about to launch, including Disney+, Apple TV+, ABC’s Peacock, HBO Max, and Quibi.

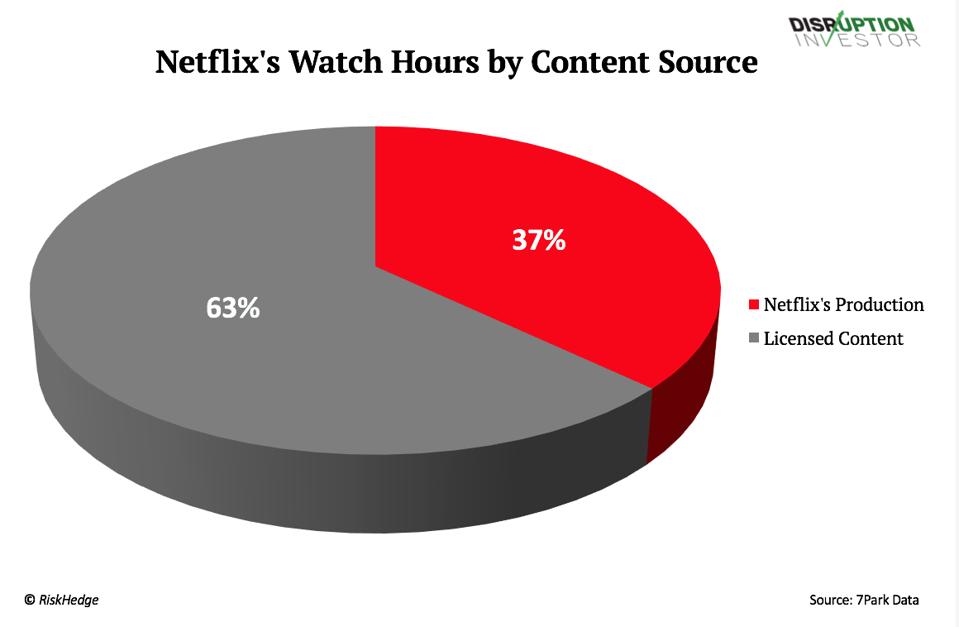

Second, Netflix was about to lose a big chunk of their licensed content which accounted for more than half of their viewing hours (primarily Disney-owned content but also popular shows like Friends, to HBO Max, and The Office, to Peacock).

In Nov 2019, the day before Disney+ was launching, Stephen McBride wrote in a column in Forbes titled ‘In 24 hours, Netflix could lose almost 25% of its subscribers‘: “the future of streaming belongs to content creators. To its credit, Netflix has changed the way we watch TV. But after 20 years, it’s still a company that “rents movies’… but now it’s doing it over the internet. It’s still just a middleman. Now that Hollywood giants have woken up, it’s only a matter of time before they catch up to Netflix. For Netflix, the battle is lost. While Hollywood spent decades and decades piling up the archives of blockbusters that span multiple generations, Netflix has just started the process.“

Third, in addition to the traditional Hollywood brigade, Apple and Amazon were looking to create original content as well, threatening to bid up costs.

Fourth, it was unclear if Netflix’s aggressive spending on original shows would pay off given the competition as well as worries about their long-term pricing power.

All these risks made it hard to value the company as the range of possibilities (both around increasing subscribers and around increasing pricing) was very wide.

What changed this year?

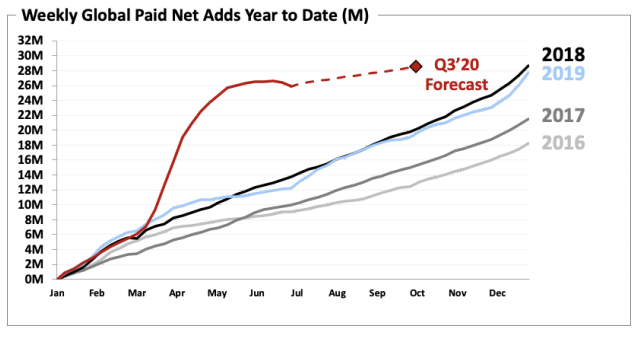

Netflix added ~16 million new subscribers in 1Q followed by ~10 million new subscribers in 2Q. To put that in context, they added 28 million new subscribers in all of 2019. This growth spurt due to the Coronavirus crisis brought their total subscriber base to 193 million. Commenting on their subscriber growth, Ben Thompson, who is one of the best technology analysts covering the company, wrote “I do think the financial impacts of this pull-forward are being under-appreciated: 8 million subscribers signing up 6 months sooner than they would have otherwise, to pull two numbers out of thin air, is worth an additional $84 million per month in revenue, and given that that is for a subscription, it is revenue that is additive to however much Netflix would have earned from them in the future. Similarly, the money that Netflix is saving on content production that isn’t happening is likely to push back other production in years to come; this quarter’s unexpected positive cash flow doesn’t necessarily mean that Netflix has to pay it back in the future.“

In other words, the positive effects of accelerated subscriber growth are not temporary. As lockdowns end and people start venturing out of their homes, average viewing hours per customer will come down…but that is not the same as saying that ARPU (average revenue per user) or total revenue will come down. Netflix’s topline will continue to benefit from the increased subscriber base. There might be some increase in churn but fears of en masse subscription cancellations are overblown.

Further, this is a business where there are incredible returns at scale. In Jan 2019, Barry Diller, chairman of IAC (which owns multiple media and internet brands across 100 countries), said, “Once [Netflix] has built up to 200 million or so subscribers, it’s very hard for anybody to come close. Eventually, the dollars will rationalize, and I think [Netflix’s] cash flow will be huge”. With the recent bump in subscribers, Netflix has created an incredible lead.

Meanwhile, most of the competitors (Disney+, Apple TV+, HBO Max, Peacock, and Quibi) have already launched their streaming services. Except for Disney+, most have been underwhelming if not outright failures.

The crisis has blunted the competitiveness of Disney+ also. Although it provided an immediate subscriber boost shortly after launch, it also reduced Disney’s financial resources and management attention as the company’s movie and theme parks divisions remain crippled.

The crisis has also slowed down content creation for everyone else, as the production of many shows get halted by the virus, while Netflix (due to its aggressive investment in content last year and its tendency to produce entire seasons of shows upfront) is less affected. Netflix elaborated on this point in their Q1 shareholder letter: “Well, the one thing that’s maybe not widely understood is we work really far out relative to the industry because we launch our shows all episodes at once. And we’re working far out all over the world. So our 2020 slate of series and films are largely shot and are in postproduction remotely in locations all over the world, and we’re actually pretty deep into our 2021 slate. So we aren’t anticipating moving things around.“

The upshot is that Netflix represents a safer value proposition now than it did a couple of years ago. Investing is about gauging risk-reward, and we feel the Covid-19 crisis has substantially reduced the risk to Netflix’s investment thesis.

The long-term investment case

Given Netflix’s business model, where the marginal cost of serving a new subscriber is essentially zero, it has been clear for a few years already that Netflix would dominate their segment if they had 1) the most subscribers, 2) a good enough content library, and 3) effective recommendation algorithms to surface relevant content for each subscriber.

Now that Netflix has the largest subscriber base by far, their flywheel is spinning at full speed. In a recent interview, Matthew Ball, former head of strategy at Amazon Studios, said: “If Netflix can launch worse content to greater success than you can, and because of its greater scale it can economically do that, that’s a huge advantage.”

Netflix already spends around $17 billion on content annually – more than anyone except for Disney – and we expect this to flatten out at around $30 billion annually in a decade. Soon, many of their sub-scale competitors will realize that they can make more money selling/licensing their content to Netflix (which can monetize that content much more effectively) versus trying to build up their own streaming businesses.

Over time, Netflix’s value proposition to existing and future customers will continue to go up as they add content at a furious pace. It is also clear that as the value proposition of their content library improves, Netflix will increase prices.

At scale, the combination of higher subscription charges combined with flattening content costs will generate prodigious cash flows.

Thoughts on valuation

It is not an easy task to value Netflix precisely when they are still focused on rapidly growing subscribers and cementing their lead as the dominant global media streaming company. However, it is easy to see that this is an incredibly profitable business at scale.

The recent quarterly results provided a glimpse of just how profitable Netflix will be once they have saturated the market. In the recent quarterly investor letter, management said, “We’re often asked by investors what our FCF profile would be at “steady state” or when our cash content spending matches our content amortization. The pandemic and the resulting pause in productions provides one early snapshot of what that may look like. In Q2’20, our cash spending on content was $2.6 billion, equivalent to our content amortization of $2.6 billion, or a 1x cash content-to-content amortization ratio. This resulted in a FCF margin of +15% in Q2. Of course, our plan is to continue to grow our content spend (as we don’t believe we are anywhere near maturity), but the above analysis may prove illustrative.”

Our expectation is that once Netflix has saturated their potential subscriber base, their expenses will also start to rationalize, and the full pricing power will come to bear. Based on our projections, in five years, Netflix should reach 350-400 million subscribers and ARPU should go up to ~US$15 (maybe even $20 in an optimistic scenario). If our projections prove accurate, we think Netflix can easily trade at a market cap of US$400-600 billion in five years versus their current market cap of US$210 billion (which is equivalent to ~US$480 per share). This should provide a mid-to-high teens returns CAGR from current levels.

We also think that a dominant consumer facing application like Netflix with 350-400 million engaged subscribers will provide multiple opportunities to make money outside of the core subscription model. These could deliver further upside to our estimates depending on how management decides to pursue these alternate paths.

Given the attractive risk-reward, we recently increased the size of our investment in Netflix.

P.S. This post is excerpted from our firm’s recent investor letter which my partner GC and I wrote together.

Disclaimer: Our firm owns shares of Netflix. This is not a recommendation to buy, sell, or hold the stock. We may change our mind on the company at any time without informing you (or updating the blog). You shouldn’t be taking investment advice from a stranger on the internet anyway.