In Pt 1 (here), I introduced the American networking company Ubiquiti Inc and its founder Robert Pera. I discussed Ubiquiti’s products and their aggressive share buybacks.

In Pt 2 below, let’s explore why the company is so profitable. After all, they are funding these buybacks through the free-cash generated by the business.

In Part 3 (here), I put together our responses to the most common questions we get asked about our investment in Ubiquiti.

I first heard about Ubiquiti in Jan 2015 at an investor conference. Their financials seemed excellent (almost too good to be true) and the valuation was very cheap. It took me a couple of years to start understanding their business strategy and their prodigious cash generation.

Business model

Before we get into the competitive advantages of Ubiquiti, let’s understand how the company developed their unique and non-traditional business model.

From Ubiquiti’s 2018 annual report:

“We believe that our products are highly differentiated due to our proprietary software protocol innovation, firmware expertise, and hardware design capabilities. This differentiation allows our portfolio to meet the demanding performance requirements of video, voice and data applications at prices that are a fraction of those offered by our competitors.

As a core part of our strategy, we have developed a differentiated business model for marketing and selling high volumes of carrier and enterprise-class communications platforms. Our business model is driven by a large, growing and highly engaged community of service providers, distributors, value added resellers, systems integrators and corporate IT professionals, which we refer to as the Ubiquiti Community.”

From Pera’s blog (writing in 2013):

“Traditional company business models aren’t built to empower customers and pass on value to them. They are built to extract profitability from them. And information asymmetry gives them the perfect cover. But, with an increasingly connected world paving the way for more and more information transparency to the customer, all of this is about to change. No longer are “Insiders” able to control the flow of information. If a product is great, soon customers will tell other customers on the Web and rave reviews spread like wild fire. Similarly, if a product is bad or customers realize they are being ripped-off, relationships will provide little recourse to contain that information from being widely disseminated.

What does this mean moving forward? As an Engineer first who enjoys building great products, and a Businessman second who has no patience for politics and inefficiencies, I feel very fortunate to be at the early stages of my career in this point of time. Moving forward, I can say with certainty that the most successful tech companies of the future will be the ones who deliver the best products and technology value first and foremost which empower customers. This is very different than the traditional business model which leverages relationships to control information asymmetries and extract profit from customers.

Three companies that I believe are positioned well in an increasingly information transparent world are: Tesla (Electric Vehicles), Xiaomi (小米科技; Smartphones), and Ubiquiti Networks (Enterprise/Carrier Technology). What is important to note is that although these companies deliver technology value very efficiently, all take concentrated R&D approaches to produce leading edge performance products which in turn generate evangelism for their brands.”

The Old Model vs. The Future Model

To summarize Pera’s thoughts, Ubiquiti made good hardware at low prices. They differentiated their offerings through their software and support ecosystem. They also leveraged the internet to build direct relationships with their tech-savvy customers for sales and support and essentially outsourced most of sales and marketing – the cost savings were passed on to consumers.

Ubiquiti’s moat

Let’s delve into Ubiquiti’s business strategy in more detail to better understand the reasons for their profitability.

1. Culture:

Pera has built a unique engineer-friendly culture at Ubiquiti where small high-performance teams get a lot of responsibility and independence to experiment with ideas.

The company pays high salaries to their engineers as they understand that a great engineer can be ten-times better than a mediocre engineer. Outside of US, they’ve built research teams at locations like Lithuania and Taiwan where it is relatively cheaper to hire great engineers.

The company also has a culture of transparency in communicating directly with their customers. Ubiquiti does not employ a large direct sales force, but instead drives brand awareness largely through the company’s user community where customers can interface directly with the company’s R&D, marketing, and support. These direct interactions with customers also provide a tight feedback loop for product and feature development.

2. Unique Sales Model:

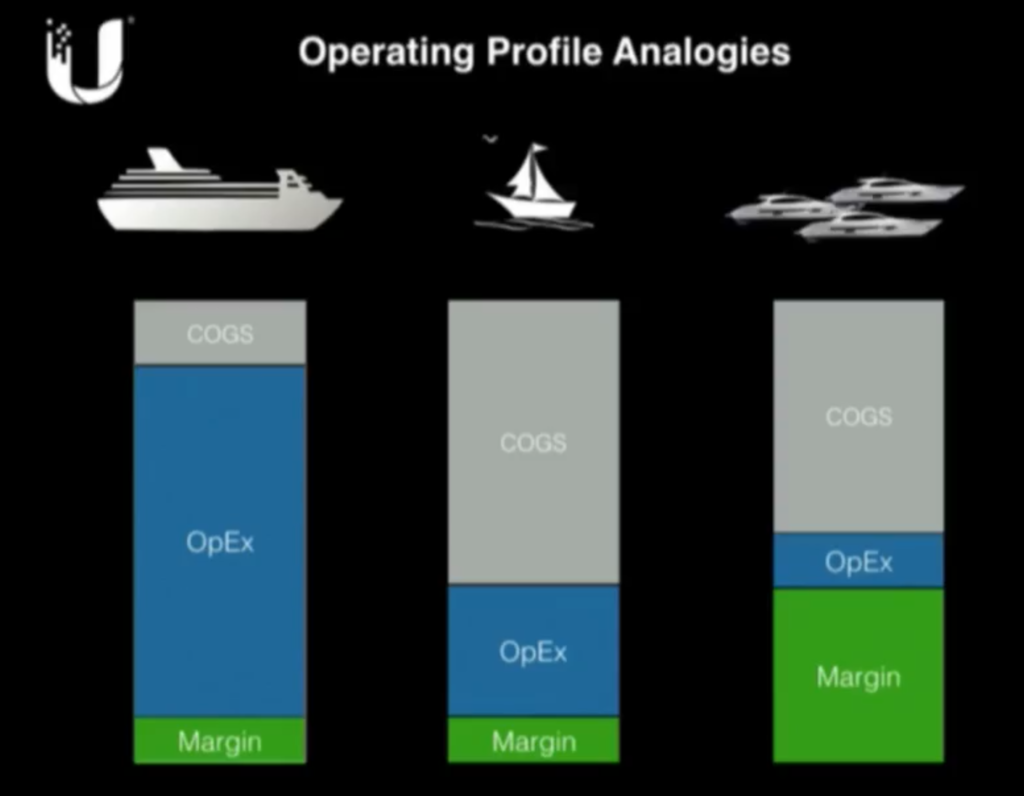

Ubiquiti’s gross margins are actually not very high compared to the industry – see table below:

Despite average gross margins, they are still so profitable because their sales model is completely different (from competitors). From their 10K: “We do not employ a traditional direct sales force, but instead drive brand awareness through online reviews and publications, our website, its distributors and the company’s user community where customers can interface directly with R&D, marketing, and support”:

Traditional competitors like Cisco find it very difficult to compete with this model as they have a large existing sales force and any transition towards a direct-selling model is very painful as it would involve lower margins and cannibalisation of existing business.

3. Customer lock-in and high switching costs that come from building sustainable platforms/ecosystems:

From a good writeup on Ubiquiti’s ecosystem by Michael Huber (in 2017): “In the first instance, the ecosystem’s power is derived from communities. While investors unfamiliar with networking can debate the number of logins on the communities and whether they are boosted by the presence of bots, these arguments entirely miss the point. If you are deploying a network and you have a problem with Ubiquiti equipment, or even just a question that may not be directly related to Ubiquiti, you can log in to the Ubiquiti community, search your problem, and find an answer almost 100% of the time as all past discussion streams are cataloged and searchable. This is a major shift in power away from the pay for support model, where the cost is not just the support contract but the time wasted getting to the right person to get the answer. As a result, the Ubiquiti ecosystem enables non-experts to deploy and troubleshoot basic networks. Not only does the equipment cost half or less than competitor products, there is no service contract to be purchased, and you can deploy the equipment with the IT staff you already have without having to hire or certify new IT staff people.

Similarly, in the WISP space, Ubiquiti’s technology can be deployed by the many small operators without having to find expensive, highly certified technicians who, incidentally, don’t tend to live in the areas where WISPs operate. We attended WISPAPALOOZA last week in Las Vegas, and WISPS are typically run by scrappy entrepreneurs. Ubiquiti gives them a way to learn to do things themselves, which saves them time and money, and it’s a core part of their success. The community, and the many years of troubleshooting history it contains, is an enormous asset to Ubiquiti’s carrier customers.

The communities, however, are actually the old news. The more recent news are the software platforms and apps that Ubiquiti has rolled out in recent years: Unifi for the enterprise; Video for their video products; Umobile for the Airmax products. There are a two things to note about these platforms:

1) they are cloud based software platforms that are free and, once set up, enable Ubiquiti’s products to be provisioned, updated, rebooted and monitored by anyone with an iPhone.”

2) they provide tremendous visibility into the network quality, usage patterns and facilitate network troubleshooting.

Are these products unique to Ubiquiti? No, but they are excellent products and come free with Ubiquiti’s already inexpensive products. Furthermore, once you have them deployed, they make it extremely easy for anyone with permission to add additional Ubiquiti products to the platform, which drives future sales.“

(Unifi Network Management Controller – local and cloud based access for Network administrators)

4. Integrated systems and encryption make it difficult for competitors to clone their products

One of the obvious questions is what stops their Asian OEMs (or other competitors) from producing similar gear themselves and selling it at a lower price?

The answer is that hardware is only one part of the overall system. Their integrated software ecosystem is not easy to replicate. Let’s go back to the company’s early days to see what happened.

Snippet on SuperRange from Pera’s blog:

“In 2005, Ubiquiti would launch its first product called “SuperRange” – essentially a super-charged Wi-Fi module for long-distance outdoor wireless applications… The appeal of our “SuperRange” module was that it performed better over long-distances compared with the standard commodity Wi-Fi modules being sold in volume…

However, there were 2 disastrous variables working in the background that would inevitably be fatal to my initial business strategy:

Our $35 manufacturing cost was representative of our economies of scale in 1,000’s of quantities. In contrast, the popular commodity modules had a $20 resale price were coming from Asia in 1,000,000’s of quantities. Interestingly, there was no significant intrinsic design or manufacturing cost premium in our enhanced design compared to the commonly sold commodity module. We were just completely outmatched with our competitors from a manufacturing volume/cost leverage standpoint.

Our improvements were simple HW design additions that could easily be copied

You can imagine what happened next. The commodity Wi-Fi module manufacturers soon noticed our growing business and gross margins and said “Hey, this is a great idea; we can manufacture a premium module design and take over their market” Within months, they copied our HW design and clones started appearing in our sales channels at below our manufacturing costs.

Overnight, growth slowed, customers turned on us saying we had no business selling such over-priced hardware, and I found myself in an impossible position to compete; I was contemplating shutting the doors and moving on with my life.

…

When Ubiquiti was faced with instant commoditization from lower-cost Asia competitor clones shortly after our initial radio module release, I quickly was forced to change development directions. I knew we could never compete with Asia competitors in a hardware only module business; if we were to survive, we had to go upstream and compete with our system customers. This would mean pulling together development resources that could deliver a complete solution to market that included investment into system hardware design, mechanical design, antenna design, and firmware development.”

Encryption: In Ubiquiti’s early days, they also had issues when one of their suppliers started to produce duplicate products and sell them as fake Ubiquiti products. To counter this, they now also build in encryption keys in all their devices so fake products don’t work with the rest of the Ubiquiti ecosystem.

The company’s hard learnt lessons from the early days made them laser focused on developing their proprietary software ecosystems as well as encryption that made copycat products incompatible with Ubiquiti’s ecosystem.

A company’s moat typically manifests itself in the form of profitable growth and Ubiquiti has been exceptional both in developing new products to grow the business as well as maintaining high profitability.

Revenue Growth by Segments

Along with good revenue growth, their gross margins have gradually improved from 42.2% in FY13 to 47.3% in FY20 – this is partially due to their operational improvements and partially as the Enterprise segment has slightly higher gross margins versus the Service Provider segment.

Financials and Valuation

Over the last seven years since FY13 (which was the first year excluding the IPO year) to FY20, Ubiquiti has grown:

- topline from $321mn to $1.3bn (CAGR of 21.9%) – as they expanded into new areas and adjacent product lines

- operating profit from $93mn to $478mn (CAGR of 26.4%)

- net profit from $81mn to $380mn (CAGR of 24.8%)

- (diluted) EPS from $0.89 to $5.80 (CAGR of 30.7%) – because of aggressive and well-timed share buybacks

- free cash flow from $127mn to $430mn (CAGR of 28.7%)

It’s worth noting that we don’t need to make a lot of adjustments to Ubiquiti’s financials. They rarely hand out stock options so their accounting earnings and cash flows track closely over time. They are also very capital efficient: in FY20, their total capex was just $31 million.

In FY20 (latest year ending June), Ubiquiti generated ~$430 million in free cash flow. At their recent share price of US$160 per share, their enterprise value is around $10.8bn (mkt cap $10.3bn, debt $680mn, cash $144mn). So the company is trading at 25 times free cash flow or ~4% free cash flow yield. We feel this yield is more “real” than in other companies because management has been very disciplined about capital management and very aggressive about returning capital to shareholders.

For us, valuation is about getting a margin of safety to our purchase price. In the case of Ubiquiti, even without building in any growth, current valuation is reasonable if this level of cash flows can sustain. And the company’s stock buyback provides a very strong support less than 15% below current levels. They were recently buying back stock at $138 and, in another year’s time, will probably raise this price above $160. [Please note that the original article was written in September and references the share price at the time].

In our opinion, the key driver to watch is long term revenue growth in their Enterprise Segment which has, at least in the short term, taken a hit. We think this is a temporary hit due to Covid.

In their last investor presentation in Nov 2017, the company had provided their own long term expectation of how their financial profile will look like. So far, it has been a good roadmap for building a financial model.

Ubiquiti’s Main Competitors

| Backhaul | Cambium Networks, Ceragon Networks, DragonWave, MikroTîkls, Airspan, SAF Tehnika and Trango |

| CPE (routers, switches, gateways etc) | Cambium Networks, MikroTîkls, Ruckus Wireless (Arris) and TP-LINK Technologies |

| Antenna | PCTEL, ARC, ITELITE and Radio Waves |

| Enterprise WLAN | Huawei, Aerohive Networks, Aruba Networks (HPE), Ruckus Wireless (Arris), Cisco Meraki and Cisco |

| Video surveillance | Axis Communications, Hikvision, Mobotix and Vivotek |

Key Risks

- Market saturation in the Enterprise Solutions segment

- Key man risk: it is still largely a one man show

- satellite-based internet providers, such as Starlink, could be a major long-term threat to the WISP business

- Fraud – very unlikely, but they’ve been a target of short-seller smears

Additional Resources to understand the business

- Robert Pera’s blog: https://rjpblog.com/

- Ubiquiti Investor relations: http://ir.ui.com/financial/financial-filings

- Investor presentations: http://ir.ui.com/news-events/events-presentation

- Products: https://www.ui.com/products/

- Ubiquiti user community: https://community.ui.com/

Disclaimer: Our firm owns shares of Ubiquiti. This is not a recommendation to buy, sell, or hold the stock. We may change our mind on the company at any time without informing you (or updating the blog). You shouldn’t be taking investment advice from a stranger on the internet anyway.