In Pt 1 (here), I introduced the American networking company Ubiquiti Inc and its founder Robert Pera. I discussed Ubiquiti’s products and their aggressive share buybacks.

In Pt 2 (here), I explored Ubiquiti’s unique business strategy and the reasons behind their high profitability.

Finally, in this third part, I’m putting together some of the most common questions we have been asked regarding our investment in Ubiquiti.

1) How do you go about forecasting the company’s revenue? And if you don’t have visibility, how do you get comfortable with that?

We spent a lot of time thinking about the opportunity size and the total addressable market. However, the company operates in segments where even management themselves didn’t really understand how big the end-markets could be. Secondly, they have entered new areas with new products several times. Given their history of innovation, we have decided to be patient and let things play out. We don’t forecast but we do track their progress.

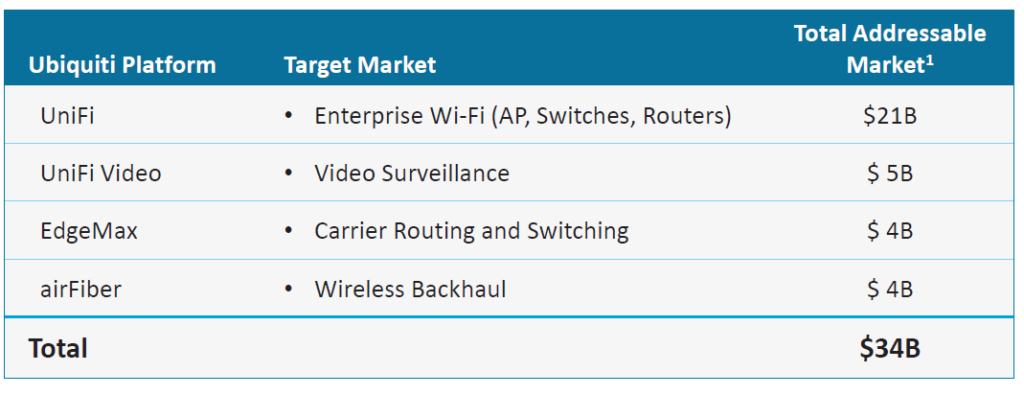

Still, it is instructive to look at the company’s own TAM estimates. The table below is from a company presentation in 2017:

2) Is this a good business?

Yes, indeed. Just look at the historical free cash flows and return on invested capital – all while maintaining good growth.

3) What do you think about Citron’s short case?

Link: http://www.citronresearch.com/citron-exposes-ubiquiti-networks/

Let’s go back and revisit the chain of events from 2017.

On 3rd Aug 2017, Ubiquiti announced good results and guided strong FY18 growth: revenue and EPS were expected to grow 24% and 29% y/y respectively, based on the midpoint of the guidance range. Management was also very positive on the outlook for the company’s enterprise WiFi products as well as the company’s potential to improve margins. The next day shares rallied over 20% and reached all-time highs in subsequent weeks.

Shortly afterwards, on 18th Sep 2017, short-seller Citron Research released a negative report on Ubiquiti causing the stock to fall sharply. The report included many allegations, the most serious being that overseas cash did not exist and that key offices and key personnel were shams.

Over the next few weeks, by evaluating the company’s responses and the reactions of other investors, we came to the conclusion that the short-seller’s allegations were largely baseless. To be fair, there were a couple of minor points in the short-seller report that were correct but they were minor lapses of a frugally run company rather than fraud.

To us, the key point was incentives: as a 70% owner, it would be against the interests of founder and CEO Robert Pera to sabotage his $3bil stake (at the time) in Ubiquiti. The company had largely been self-funded and hadn’t raised significant amounts of capital from the market. If management were committing fraud, they would primarily be defrauding themselves! Also, we noted that (1) Pera did not draw a salary from the company and (2) the company had returned cash to shareholders via share buybacks. If Pera wanted to extract money from the company, there were easier and more legitimate ways to do so, such as paying himself a hefty salary or paying dividends instead of buying back shares.

In early 2018, Ubiquiti put the main accusations, about non-existent overseas cash, to rest when it announced repatriation of $677.2 million (most of their overseas cash) from its foreign subsidiaries to U.S. banks and used this cash to further fund the company’s share buybacks.

Citron’s report said “either Robert Pera is the best CEO in networking equipment, or Ubiquiti is committing FRAUD”. If we are now convinced that Ubiquiti is not a fraud, then perhaps it is time to admit that Pera is an exceptional CEO.

4. What is your view on the market share trends, stability of market structure, market growth? Does having a market view matter more in the fast-moving world of technology?

For us, it’s less a market view and more a view on Ubiquiti’s track record of introducing innovative new products.

We don’t have a strong view on market growth though we’ve looked at projections. We do think that the Covid crisis has raised the importance of good internet connectivity. After the short term slowdown, we expect continued growth in the enterprise market.

Based on IHS Markit data, the enterprise WLAN market revenues grew at a 12.4% CAGR from CY10-18 from $2.5B to $6.4B and is expected to grow at a 7.6% CAGR CY18-23 from $6.4B to $9.2B, respectively. Now it’s worth noting that this projection is just for access points and controllers. Ubiquiti has other products in enterprise and is also targeting new product lines like cameras and door access products that they can upsell to their existing customers.

Market share data in WLAN by Revenue:

5. Is the business cyclical? Do customers treat the purchase as a major capex item?

The Enterprise segment might be cyclical eventually but the market is not saturated yet and we are still in the growth phase. In the short term, the Covid crisis will certainly be a dampener on growth. For most enterprise customers, this is capex but not a major item. Think of a hotel installing (or upgrading) WiFi on their premises.

The Service Provider segment is more mature but continues to see mid-single digit growth. For these customers, the equipment is a major capex but that capex is key to their business.

6. What is the longer term impact of 5G/LTE on the Service Provider segment?

Pera has been asked this question before. His reply: “I know LTE, like CPEs and LTE home consumer type service, has been around for a while. I don’t see it impacting. We really are a cable modem replacement or DSL modem replacement. People are going to always want, in my opinion, a hardline that’s unlimited capacity where they can download and run like Netflix continuously and not worry about overage charges. And big carriers also have expensive overheads – they gotta pay for the spectrum, they gotta pay for truck rolls. AirMax, from an economic perspective, is really barebones. You have sub-$100 IPs, you have CPEs that we are selling into the channel for, as low as, sub $40. You have entrepreneurs that are willing to roll up their sleeves and deploy all the infrastructure. We target a lot of rural areas where a lot of these big operators don’t want to make the investment. We are also diversified in different geographies of the world. But it’s quite possible they will start taking market share.”

7) What are some of the new areas the company is expanding in?

The opportunity in Video Cameras:

Ubiquiti is also making a bigger push into the networked security camera space, where a big opportunity has opened up in US and developed markets because of security concerns around Chinese companies like Hikvision and Dahua. Ubiquiti has a long and frustrated history in this segment; if you go back to Pera’s statements on this topic in past earnings calls, you can piece together the narrative.

Nov 2012 AirVision, our IP video surveillance platform has been re-architected and vastly upgraded with the announcement of our AirVision 2.0 NVR and management software. We expect strong growth in AirVision over the next year and going forward.

Aug 2013 I think AirVision, I think that’s going to have a big year next year.

Aug 2014 AirVision started out of the gate when we launched it 2 years ago with great traction. But we made some mistakes in the design architecture. Largely my mistakes, and we’ve corrected them. And we’re on AirVision 2, which is the second generation of the software, and it’s getting traction again. So my hopes is you’ll see a similar trajectory in our IP video security solution growth as you’ve seen with UniFi in the past couple of years.

Feb 2015 We started in 2012, and now we’re looking at three years later. And I think over the past three years, we’ve definitely made some mistakes, some rookie mistakes, especially on the hardware side and the software side. We definitely had issues, the hardware platform we chose, the network video recording, the NVR architecture, and the user experience. And I think what you’ll see this year is, our hardware, third-generation hardware is very, very good. Our NVR is greatly improved. And the final thing we’re missing is user experience…We have made a lot of improvements to the user experience to the software. So it’s not a significant contributor to UniFi today, but I expect it to be materially very significant in the next two to three years.

May 2015 Video is one of our initiatives I’m most excited about. We’ve been working on video for 6 or 7 years, and I think we’ve finally solved it. And the direction it’s going is, I think, pretty exciting. You’re going to see some new product announcements and some software leaps forward this year… I think this year, towards the end of the year, I think I’m expecting kind of an inflection point for that platform.

Aug 2016 I’ve been trying to do video since 2007, as embarrassing as that sounds, we’ve been at this since 2007. And what’s kind of disappointing about UniFi Video is we had the right idea. In 2010 or 2011 when we launched that platform…and we were there before Hikvision and a couple of the other dominant China players today. And we were there with a complete user experience from hardware to software to network video recording at a really disruptive price point. And everybody wanted that product. And if we executed, it’d probably be, I don’t know, hundreds of millions of dollars of revenue today. We just didn’t do it, and we missed the time window. But like we did with UniFi, we pretty much evolved the team, replaced the team over the past year, year and a half, two years, and we’ve made some fundamental changes to the controller. And you’re seeing now it’s more stable. The hardware is on generation three. It’s better. But we’re not done. I think by the end of this year, I think we’re going to make a pretty big step in video that’s going to boost its growth a lot more.

Aug 2017 Video is a huge opportunity for us, our solution isn’t that good today, it still sells hundreds of thousands of cameras a year. Once the underlying issues are fixed…I think you will see camera sales go from hundreds of thousands a year to millions a year… We also have more complimentary technologies to add to UniFi. Our vision is you go into a building one day and you will see UniFi running everything, everything from the automation to the lighting to the Wi-Fi piece to the door security systems to the video security systems and more.

Feb 2018 Another big catalyst in the UniFi world is video. We’ve overhauled the team and the R&D strategy about two years ago. And I think what you’ll see in the later half of this calendar year is UniFi Video turning the corner much like UniFi did in 2016, 2017. So we’re on our fourth generation of UniFi Video technology and we’re going to significantly reduce the pricing and significantly increase the performance and the user experience. And that’s all going to start in the next few months with the release of UniFi Video 4. [Hikvision’s issues in the American market started around mid-2018.]

May 2018 Video is picking up, we’re taking it into adjacent markets and we’re trying to create a complete collection of technology all consolidated within the one UniFi Controller platform… I think our next generation of video we finally got right.

Aug 2018 So, we are continuously making good cost reductions, but we also plan to continue to be aggressive on new product introductions. For example, video security is something I think we should have a much larger market share of and we are going to be very aggressive with UniFi video over the next couple of years.

To us, the salient points that emerge are:

1. Ubiquiti has been working on video surveillance for a long, long time; in fact Ubiquiti is already on its 4th generation of video surveillance products.

2. Pera keenly regrets the missed opportunity in surveillance systems; in his view, Ubiquiti fumbled the opportunity and gave it to Chinese players like Hikvision and Dahua.

3. Ubiquiti’s video offering is now integrated into a broader WiFi platform.

Not only is video surveillance a high-growth market, the size is large enough to have a significant impact on Ubiquiti’s numbers. We estimate Hikvision’s sales in the U.S. to be roughly $360 mil in 2018. Given Ubiquiti’s last-four-quarter revenues of $1.1 bil, Hikvision’s piece of the pie is significant for Ubiquiti.

While it’s true that Pera has had a history of overly optimistic expectations on the video surveillance front, (1) with Hikvision and other Chinese brands hobbled by security concerns, and (2) an improved product line that’s integrated into a larger WiFi system, we think that Ubiquiti’s competitive position is very strong this time. Pera knows that he fumbled this opportunity in the past, and we’re sure he’s going to make the most of this second bite at the apple.

Unifi Access: Door Access reimagined

Another example that shows how Ubiquiti’s Enterprise Wifi system can be a platform for additional functionality. After introducing video surveillance, Ubiquiti has just launched an access control system.